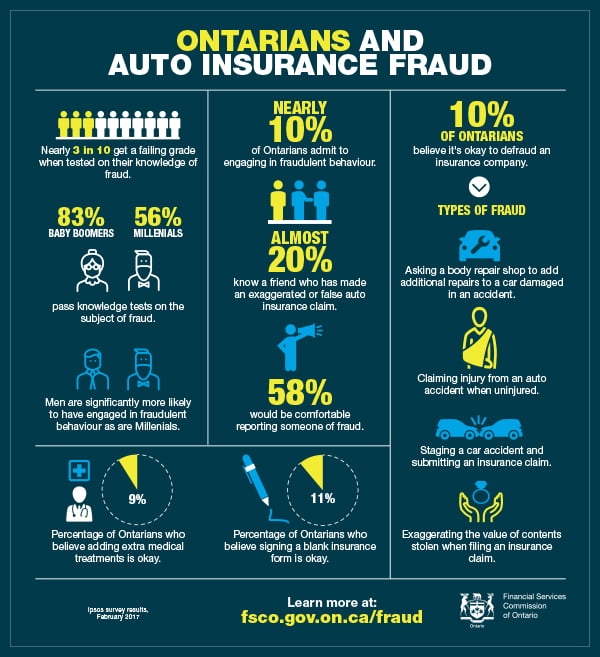

Did you know that auto insurance fraud costs Ontario billions per year, with nearly 10% of Ontarians admitting to engaging in fraudulent behaviour? What many fail to realize is that making a false insurance claim or willingly/unwillingly participating in fraudulent behaviour is an illegal offence under the Federal Criminal Code, and will also cost you in higher insurance premiums as a result. In order to Recognize, Reject and Report auto insurance fraud, one must first understand what classifies as fraud, how to protect yourself from it and what consequences may follow if you commit fraud.

Photo via FSCO

What is auto insurance fraud?

Auto insurance fraud is the deceit, falsehood or other dishonest act committed to defraud, or to attempt to defraud, an insurance company. According to the Financial Services Commission of Ontario (FSCO), the following are some examples of common types of fraud:

- Participating in and/or organizing staged auto collisions

- Lying about the way a loss occurred

- Filing fraudulent automobile accident or damage claims

- This includes previously existing damage to a vehicle when submitting a claim for new damage

- Conspiring with health care providers to receive payments for health treatments not received or warranted

- Presenting or filing a false and misleading document or information

Photo via FSCO

Other forms of auto insurance fraud include acts done to you out of your control and without your knowledge, such as:

- Staged auto accidents: Fraudsters can deliberately stage collisions to make insurance claims, and they could try to involve you.

- Purchasing auto insurance: Scammers may pretend that they are licensed to sell you insurance.

- Tow truck scams: A tow truck driver may be paid a referral fee by a vehicle repair or body shop to have damaged vehicles towed there. These types of tow truck drivers are known in the industry as “chasers.” To recover these referral fees, tow truck drivers and vehicle repair or body shops may “pad” their bills. In the end, you and other policyholders end up paying.

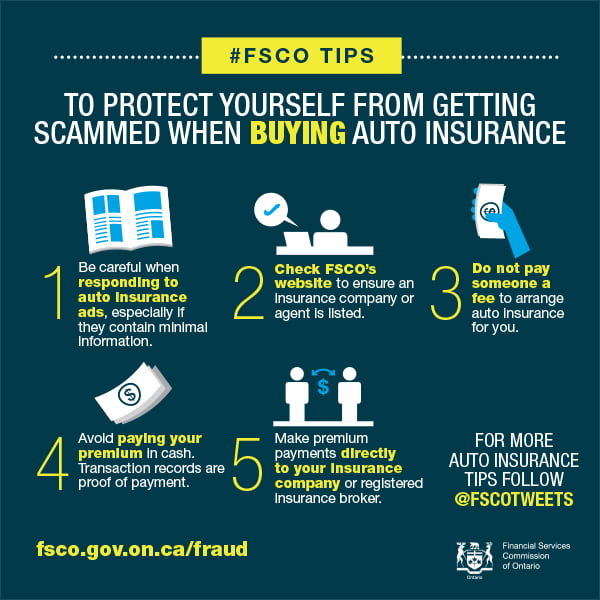

Tips on how to avoid insurance fraud

Insurance companies and law enforcement are making great efforts to fight fraud, but they need your help to be successful. These are the FSCO’s tips on how to combat and reject participation in automobile insurance fraud:

- Reading and understanding your insurance policy. Your policy provides specific details about your insurance coverages, your rights, and your responsibilities under the contract. If you have questions, call your insurance provider.

- Rejecting any type of auto insurance fraud. This includes:

- Filling out and checking over your auto insurance application or claim forms carefully to make sure you haven’t made any mistakes

- Never signing blank insurance claims forms

- Keeping detailed records: get the names, addresses, phone numbers, license plate and driver’s license numbers, and insurance information from all those involved in an accident. Take photos of the accident scene. Record the age and gender of those involved, including by-standers

- Refusing to sign any documents or agree to any terms at the site of an accident

- Demanding detailed repair and medical bills – make sure you received all the goods and services you were billed for

- Reviewing benefit payment information from your insurance company to confirm that treatments, medical providers and dates are accurately listed

Photo via FSCO

Penalties for participating in fraud

Auto insurance fraud is a Federal Criminal Code offence, and penalties for such involvement may vary. According to the FSCO, if you are caught committing or attempting to commit insurance fraud:

- Your claim will be denied

- Your insurance policy may be cancelled

- You may pay higher premiums in the future

- You may be denied insurance in the future

- More importantly, the offence is punishable on conviction by a maximum of 14 years’ imprisonment for cases involving an amount over $5,000 or otherwise a maximum of 2 years’ imprisonment

If you suspect fraudulent insurance acts or believe to have been unknowingly involved in a scam, contact your local authorities and your auto insurance company or broker. For more information on what you can do to avoid auto insurance fraud, please visit fsco.gov.on.ca. You can also submit an anonymous tip to Crime Stoppers (1-800-222-TIPS) or file a report to FSCO’s Auto Insurance Fraud Hotline or call 1-855-5TIP-NOW.