As of late, there has been an increase in interest in Usage-Based Insurance (UBI). The Intact Insurance my Drive program is a great way to save money on auto insurance while rewarding safe driving. Whether you drive your vehicle for pleasure, convenience, or business/sales purposes, my Drive can provide a quick and easy way to save money on your car insurance premium. In this article, we’ve got everything you need to know to start saving faster.

What is my Drive?

Intact Insurance my Drive is an online program that allows participants to earn rewards while driving safely, including up to 25% off auto insurance. Rewards can include car + home discounts and multi-vehicle discounts. Participants need to drive at least 1,000 km during a collection period for the app to receive accurate data. By joining my Drive, you will also receive personalized driving tips to help improve your habits to keep the roads safe. Under the same policy, all drivers who register for my Drive will receive a text message with instructions to activate the program. Once you activate it, you are ready to start driving! Discounts will apply to any vehicle, given that you are the principal driver on the policy. Vehicles that you use for commercial or rideshare purposes do not apply.

Visit the Terms of Use to ensure your vehicle is eligible.

How does my Drive work?

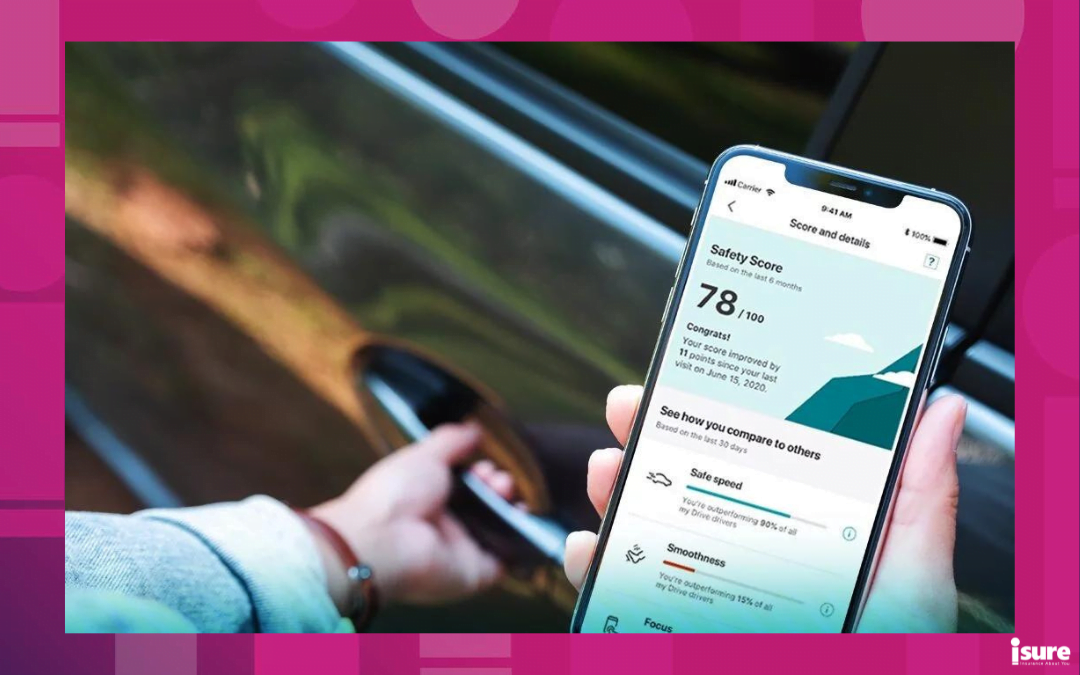

Participants can monitor their driving and earn rewards and discounts with a personalized dashboard and real-time driving stats. The program generates a safety score compiled with data from three factors:

- Safe driving speed

- Driving smoothness

- Driving focus

The safety score keeps drivers aware of their driving habits and works towards discounts on auto insurance. The app requires your smartphone’s location services to track driving, motion sensors on iPhones and making/managing phone calls on Android devices. These features allow the app to track your driving in real-time. myDrive will track the use of your phone during your trip, but myDrive will access no phone calls. Confirm whether you are primarily the driver or passenger in a car and how frequently you use public transit to avoid discrepancies with the app. The app will consume 3%-6% of your phone’s daily battery use and will not work if the battery is under 20%. As a result, 30-60 MB of data will be used per month.

How do I sign up for Intact Insurance my Drive?

To sign up, you should speak with your isure insurance broker. my Drive is activated through Intact’s free smartphone app, which you can download either on The App Store (iOS 12.0 or later) or Google Play (requires Android 7.0 and up). Once the Intact app is downloaded, customers can activate the program. An initial enrollment discount will be applied for the first six months of membership. If you already have the Intact app, you may have to update it to receive my Drive program. You will be unenrolled if you have not activated it after 15 days. Contact your isure broker to cancel the membership if you no longer wish to use the program,

When will the cost of my car insurance change?

180 days after joining the program, your initial 10% enrollment discount will typically be replaced by a larger discount. When collection periods end, or once you have driven 1000 km, your account will automatically update your current rates. Don’t be concerned if the app rates are different from policy documents; In contrast, policy documents are updated approximately every six months, at mid-term or at renewal; my Drive automatically updates after every trip. Intact will offer a refund if you have already paid premiums in full if the premium has decreased. When your policy is renewed, the premium rates will depend on various factors beyond the program.

How are discounts calculated?

Discounts are calculated over several trips using the following criteria:

- Braking (e.g., harsh braking)

- Acceleration (e.g., sudden acceleration)

- Turning (e.g., cornering)

- Distance driven

- Time of day

- Type of road driven on

- Speed

- Distracted driving

These driving events are then analyzed based on factors, such as:

- The severity of the event

- The speed at which myDrive registered the event

- Time of day

- Left or right turns

How will my insurance premium be affected?

Depending on individual driving habits, premiums may increase or decrease when using the Intact my Drive program.

Is my data protected within the Intact Insurance my Drive app?

All information tracked is shared with TrueMotion, Inc., a mobile telematics company, which helps run the app alongside Intact. The information in your Safety Score is private and isn’t shared on your policy. If in a car accident, police are also unable to access your information without proper legal authorization or your consent.

We hope that this article helps you decide if the Intact Insurance my Drive program is best for you.

If you require more information about the my Drive program or app, call your isure broker today or contact Intact directly.