With the warm weather upon us and pandemic restrictions lifting, what better way to hit the open road than on two wheels? Interest in motorcycle purchases has been gaining traction as of late. Whether you are thinking about purchasing a cruiser, touring, sport bike, moped or motorized scooter, you’ll need motorcycle insurance. Motorcycle insurance is mandatory and required by-law in Canada. Just like car insurance, all riders must have a minimum amount of coverage. For all you’ll need to know about motorcycle insurance, we cover the basic coverages, as well as offer suggestions for enhancing your policy. In addition, we discuss factors that can affect your premiums and how to save money while reducing your risk of loss.

What is mandatory motorcycle insurance?

Having a standard motorcycle insurance policy is mandatory in all Canadian provinces. All riders must have a minimum amount of coverage. Motorcycle insurance works similar to auto insurance. The main difference being that your insurer often will require you to have higher limits. Motorcycles are considered more dangerous, meaning there is a greater chance of injury or even death.

Standard minimum coverage

Motorcycle insurance protects you in the event of a loss. Loss can be a result of an accident, theft, vandalism or damage. To drive a motorcycle in Ontario, you are legally required to have:

- Third party liability coverage

- Accident Benefits coverage

- Direct Compensation Property Damage (DCPD)

- Uninsured motorist coverage

Add-on coverage

Your choices for additional, optional coverage, include:

- Collision or upset coverage: Damage to your motorcycle from a traffic collision with another vehicle or object.

- Comprehensive coverage: All other insured damage to your motorcycle (except collision or upset).

- All perils coverage: This coverage offers both collision and comprehensive protection, as well as increased theft protection.

- Specified perils coverage: Protects your motorcycle from certain risk, such as losses due to fire, flooding, hail or theft.

Endorsements

You can choose to enhance your policy with add-ons (endorsements). Factors, like the cost of your bike and how often you ride it, can help you decide which endorsements make the most sense for your needs. Some of the more popular add-ons for motorcycles include:

- Coverage for transportation replacement (OPCF 20)

- Liability for damage to non-owned automobiles (OPCF 27)

- Accident forgiveness (OPCF 39)

- Removing depreciation deduction (OPCF 43)

If you’re unsure which add-ons you may need, ask your isure broker for more information. They can help you get a sense as to whether or not an add-on is necessary.

Different motorcycles – Different licensing requirements

Just as it is with cars, the type of motorcycle you ride will have an impact on your insurance. Therefore, in order to have low cost insurance, the bike you choose is critical.

To drive a motorcycle, you will need anM Class licence. The type of licence you get will depend on the type of motorcycle you want to drive. The three main types are:

- M (includes M1 and M2): For full-speed motorcycles. This includes touring bikes, standard street bikes and cruisers (ex. Harley Davidson).

- M with condition L (includes M1 and M2-L): For mopeds and motorized scooters (also called “limited-speed” motorcycles).

- M with condition M (includes M1 and M2-M): For three-wheeled motorcycles. These are considered safer, as they have three wheels.

To learn more about motorcycling licensing, click here.

FYI: The Insurance Bureau of Canada mandates that all motorcycles, mopeds, motor-scooters and motor-assisted bicycles must have insurance coverage. That is, unless you only drive them exclusively on private property.

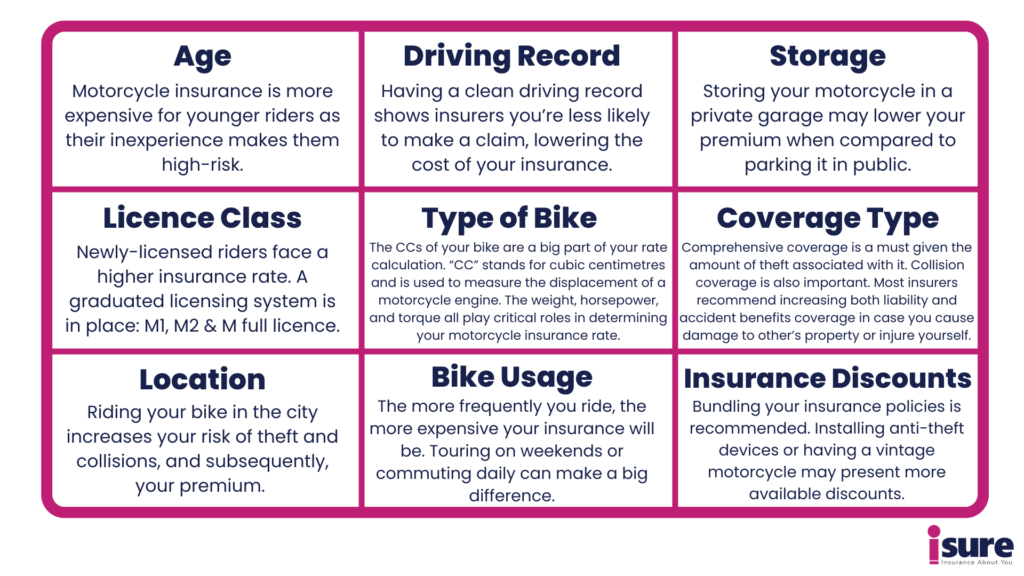

Factors that affect insurance premiums

Similar to auto insurance, motorcycle insurance is calculated based on your risk factors. The more risk you carry, the more expensive your insurance will be. Here are a few factors that can influence the rate you’ll be paying:

Cost of insurance

The average price of motorcycle insurance in Ontario ranges from $1,500 to $3,500 a year. This equates to $125 to $292 a month. However, this amount may differ drastically depending on your individualized factors. You will not know definitively what you will pay for your insurance until you have a personalized motorcycle insurance quote.

Driving without motorcycle insurance

If you are caught riding your motorcycle without a M1, M2 or full M licence, you will be fined the same way as you would for driving without car insurance. Fines range from $5,000 to $25,000 for your first offence. You can also receive a licence suspension and have your bike impounded.

Where can I get motorcycle insurance?

Not all insurance companies offer motorcycle insurance. Additionally, some companies will not insure certain types of motorcycles, such a sports models. Since having insurance is mandatory, and having the right kind is so important, you should speak with one of our isure brokers to help you compare pricing from a number of providers before making your choice.

Motorcycle insurance is year-round, not seasonal

While you may only drive your bike during the warmer months, most policies are still annual policies. You must pay premiums throughout the year. However, insurance companies realize most drivers don’t generally use their motorcycles in winter—and have factored this into the annual cost already. Some of the leading companies include:

What types of motorcycle insurance discounts are there?

If you are buying motorcycle insurance, keep these possible insurance discounts in mind. Not all insurers offer these discounts, but never hesitate to ask your isure broker if these money-saving discounts are available. Different insurance companies can offer various insurance discounts, some more common than others:

- Secure storage, i.e. Lower premiums than street parking

- Anti-theft devices installation

- Being a member of an organization, e.g. CPA

- Rider training discount

- Advanced rider training discount

- Seniors discount

Ontario offers a beautiful and diverse variety of landscapes to explore. Whether it’s a short commute to work in Toronto or driving up north to spend a day in Algonquin Park, a motorcycle is a great way to get around and experience the outdoor world. Before you head out on the road, it’s important to know and understand the different types of insurance available to you and then customize them for your unique needs and protection. No matter where are or how you ride, make sure you’re protected.