To most, self-driving cars may seem like an idea straight out of a science fiction movie. But the reality is, that fully self-driving vehicles soon will be an everyday reality. Some brands thinking well into the future with current self-driving models include Tesla, Waymo (Google subsidiary), Uber, and Lyft. If you have an interest in leasing or owning a self-driving car, you may be wondering how they will affect your car insurance rates. After all, liabilities such as accidents, will have to be handled differently than if a person is driving the car. We unpack all the information we currently have on self-driving cars and insurance rates, as well as if one is the right fit for you.

What are self-driving cars?

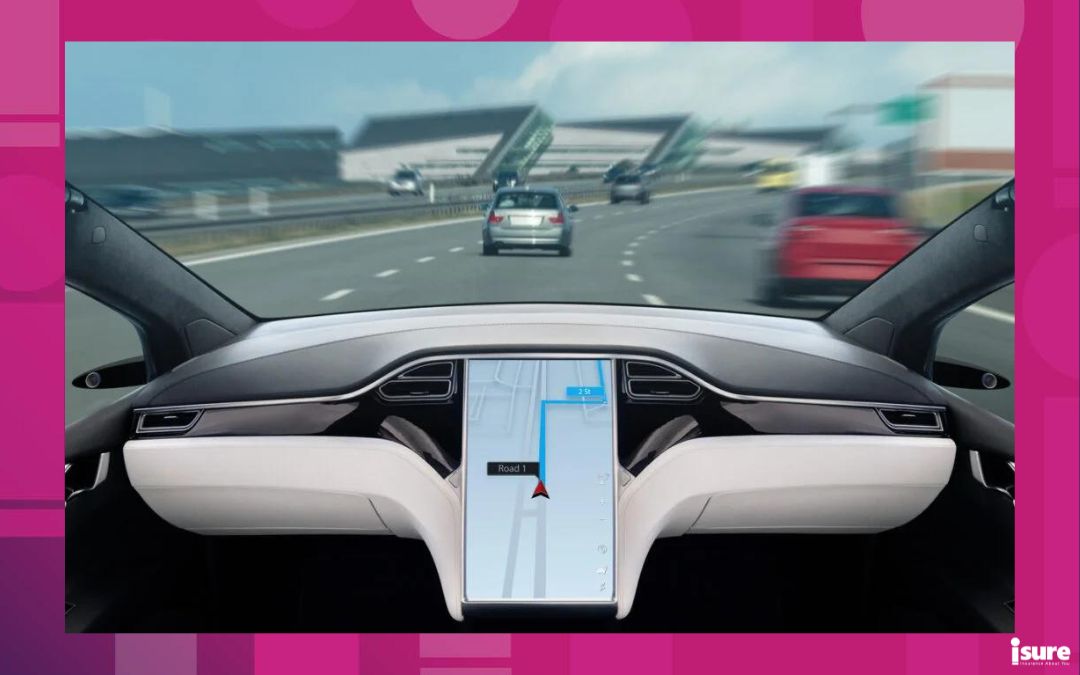

According to the Ontario Ministry of Transportation, autonomous vehicles are “capable of detecting the surrounding environment using artificial intelligence, sensors, and global positioning system coordinates.” Similar to a train conductor, you must still pay attention on the road. You can also override the automation and take over control when necessary. While these vehicles aren’t yet available in Canada, the Ontario government has now given manufacturers and researchers the green light to begin testing them on public roads without anyone in the driver’s seat.

There are five levels of car automation:

- Driver assistance

- Partial automation

- Conditional automation

- High automation

- Full automation

As the technology improves, vehicles will roll out with less need for driver interaction. The Ontario government’s 10-year pilot program will explore the financial, social, and environmental impacts of autonomous vehicles.

Self-driving cars and effects on insurance

Autonomous vehicles will undoubtedly have a significant impact on the insurance industry. It will change how premiums are determined, the types of coverage available, and how much you will pay. However, their exact impact on insurance is still unclear. Car insurance policies must change with self-driving technology. Many vehicles already come with semi-automated safety features, such as adaptive cruise control, and lane and park assist.

Experts across the board have different opinions on when the consumer changeover to self-driving cars will occur. Most experts suggest that by 2030, every car on the road will have some level of automation beyond current capabilities. The question of what the impact is on your policy with a driverless car is uncertain. Once these vehicles become industry standard, automation levels will determine pricing. This could remove traditional risk factors, such as driving history and age, from your rates.

Who’s to blame in the event of an accident?

The two main concerns insurance companies have regarding self-driving cars are:

- Liabilities: Who would be in the wrong if an accident occurs and;

- Overall safety of the vehicles.

Who is to blame for an accident will be at the heart of many claims. Does liability still rest in the driver’s hands, or does the manufacturer take the blame? Liability laws will evolve to ensure autonomous vehicle advances are not held back. If the insurance industry gets involved in self-driving cars coming to Canada, it can influence law-making and safety. Most auto insurance policies and laws revolve around human error being the main cause of accidents. Autonomous vehicles are estimated to save up to $190 billion a year in healthcare costs. The most significant advantage of autonomous cars will be an increase in safety and fewer accidents.

4 ways that self-driving cars may impact insurance

According to this report by The IBC, they predict that the four ways self-driving cars will affect insurance are:

- Insurers will end up paying more for collisions, even though collisions themselves will be cheaper claims. This is because the technology powering self-driving cars is much more expensive than traditional car technology to fix/replace.

- Since self-driving technology is so new, insurers will have to account for any equipment malfunctions.

- They believe that self-driving cars will be able to monitor vehicle activity, making policy writing much more accurate and efficient.

- Collision claims may take longer to process due to the nature of liabilities. The machine will be responsible instead of the driver.

Are self-driving cars safer?

Since most autonomous cars are still in the testing stages, it’s hard to say. It’s important to note that they are being used on public roads.

The Canadian Automated Vehicles Centre of Excellence says that self-driving cars are safer and could potentially reduce collision deaths by 80%. As technology improves, so will the safety of driverless vehicles. Developers of these vehicles say they can reduce 40,000 fatalities every year. Until then, no amount of data can replace safe driving behaviour for drivers.

What happens if I’m in an accident with a self-driving vehicle?

Right now, car insurance policies are built around the fact that most collisions are a result of human error/negligence. As we hand the control of vehicles over to autonomous technology, collisions will be most likely a result of product malfunction instead of human error. What does this mean? Many claims could involve lawsuits and disputes between car insurance companies and vehicle manufacturers. This may result in significant delays in resolving claims. With AVs coming to Canada’s roads in a few years, there is a need to update the provincial insurance laws. This will ensure that if you suffer injuries in collisions involving these vehicles, you can receive compensation faster.

Protection in an accident

If you get into a collision with a self-driving car, the IBC recommends the three major changes below. These would help make sure people who suffer injuries in collisions with self-driving cars receive compensation fairly and quickly:

- Provide a single policy covering both the driver’s negligence and stating the vehicle’s automated technology.

- Data should be given to the autonomous car’s manufacturer, along with the client and insurer. This ensures everyone is on the same page and has the same information regarding the incident.

- As federal vehicle safety standards are adjusted to meet the needs of self-driving cars, insurers should be aware of them. As such, they should then communicate these new rules to clients.

Whether or not you are in favour of self-driving or fully autonomous cars, they are not going away. They will only become a more prominent part of the auto industry as the technology improves with further testing. Only time will tell how self-driving cars will affect the way we drive. Keep checking in to the isure website for the latest updates on self-driving cars and their effect on your insurance. Also if you are looking for a car insurance quote, contact isure today.