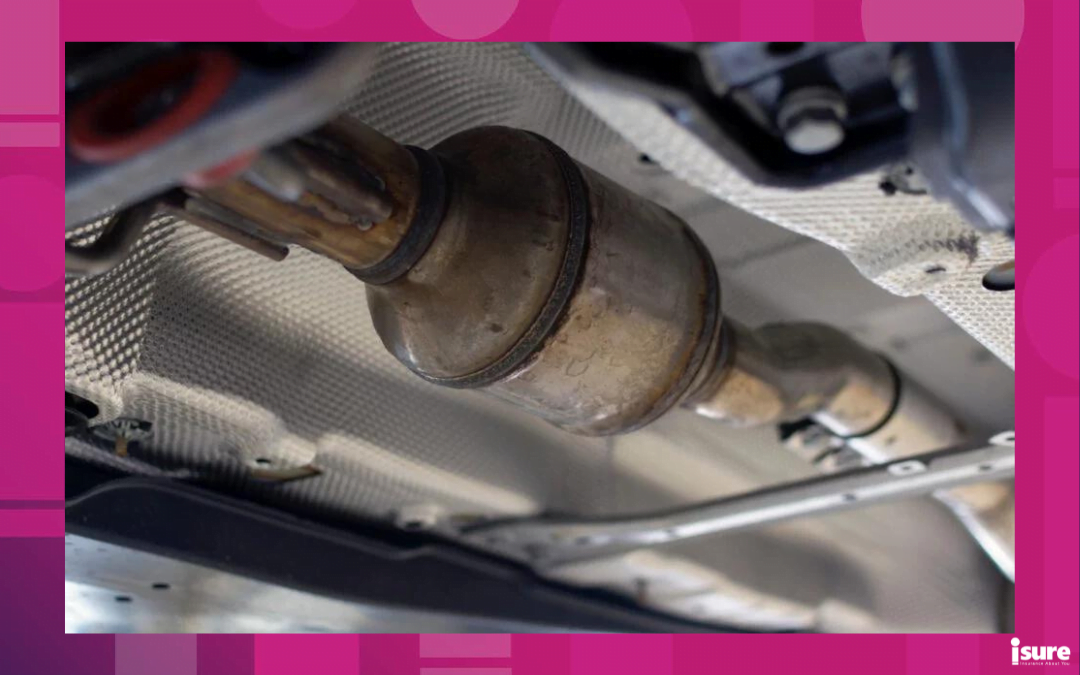

If your car is vandalized and extensive damages occur, your repair costs can be pricey. Whether it’s broken windows, spray paint on the hood, keyed doors or slashed tires, the price tag can add up quickly. Plus, thieves have recently been using hacksaws to get catalytic converters on hybrid and electric vehicles, which can also lead to expensive repairs. But the good news is that you may not have to pay for it all out of pocket. In some cases, your car insurance coverage might help you pay for the damages. Let’s discuss what vehicle vandalism is, the coverage you should have, and how to prevent it from happening.

What is considered vandalism of a vehicle?

Under the Criminal Code of Canada, a person may be charged with criminal mischief based on vandalism if he or she destroys property that belongs to another, or otherwise alters the property in some way. In order for it to be a criminal offence, the property alterations must be deliberate. Typical examples of vehicular vandalism include:

- “Keying” or damaging a vehicles paint

- Slashing tires

- Broken windows

- Graffiti

- Intentional dents

Insurance coverage for vehicle vandalism

To have protection against costs for vandalism, you will need to have comprehensive insurance coverage. This is not compulsory insurance and is an option that is available to you. Comprehensive insurance provides you with additional protection that is not included in a basic automobile policy. Comprehensive provides assurance against non-collision related threats. It includes all perils, except for collision, upset of the automobile, or damage caused by theft by a person residing with you or individuals who repair your car.

According to FSCO, this coverage pays for “losses, other than those covered by collision or upset, including perils or dangers listed under Specified Perils, falling or flying objects, missiles and vandalism.” Vandalism is included, along with natural disasters and weather, fire damage and explosions, and broken or shattered windows and cracked windshields – and others. If you are making a claim for vandalism, you will be doing this under this section of your vehicle insurance. Other types of insurance, such as specified perils, will not cover the cost of vandalism. Specified perils, also referred to as named perils, will not cover vandalism or damage from falling objects, whereas comprehensive insurance will. Other than that, they are very similar in the coverage they provide.

According to the Highway Loss Data Institute, the average cost of a vandalism claim is $1,528.

The cost of vandalism

Your auto insurance policy will cover vandalism if you’ve added comprehensive coverage to your auto insurance policy. However, comprehensive policies typically come with a deductible that you’ll have to pay before the policy kicks in. Because of this deductible, it might make more financial sense to pay for the repairs yourself.

For example, say someone damages your windshield, it may cost $550 for you to replace. Your comprehensive coverage includes a $500 deductible, so you can receive only a $50 reimbursement from your car insurance company. You might think that you are coming out ahead, but not really. The windshield claim might cause your insurer to increase your insurance rates for the next three years, and those increased rates can quickly overshadow the $50 gain you receive from your insurance company.

You will have the choice to decide what your deductible will be when you are finalizing your insurance coverage. Your insurer has a set amount for this. Most will give you the option of increasing the deductible. A lot of people like to do this so it will reduce their premiums.

Does vehicle vandalism raise your insurance?

The quick answer: Maybe.

One of the big concerns that come with filing vehicle insurance claims is: will it increase insurance premiums? Every insurance company is different – one may raise premiums over a claim when another one doesn’t. In many cases, if you are not at-fault, it may not create an increase in premiums. Insurance companies try to protect themselves as much as possible when determining premiums. Auto insurance rates are usually higher in urban areas where accidents, vandalism and car theft are more frequent. This is one of the reasons why knowing where the insured vehicle is going to be parked is important.

Be careful where you park your car

Most of the time, you may have to park your car in a parking lot that may be unattended. Here are some tips to reduce your threat of vandalism or theft:

- Out in the open. Look for a parking spot that is highly visible from the street. Those who intend to do damage to your vehicle don’t want to be seen.

- Shine a light. If parking on the street at night, do your best to park the vehicle in a well-lit area. Consider having some motion lighting installed in the vicinity of your vehicle.

- Remove temptation. Don’t leave visible items in your vehicle that may attract unwanted attention. This even includes small chargers. Make sure you put any electronics in the glove compartment or in the trunk.

- Up your security. You may want to have a car alarm installed on your vehicle. It may not stop the vandalism, but it will give you an immediate warning that someone is messing with your vehicle. In some cases, it may be enough to scare off a perpetrator.

- Park near other vehicles. Ideally, you should always park in places that have high foot and road traffic. More eyes and bodies around your car make it less likely that a vandal will chance being seen.

- Look for security cameras. A camera is almost as effective as having an actual person or group of people around your vehicle. It means that someone might be watching. And even if no one sits and watches the footage, it’s a record of what goes on. Vandals will shy away from anywhere they can be caught in the act.

- Keyless entry and ignition is key. Keys can be stolen, while traditional ignition systems may be cheated. However, most new vehicles with keyless entry pads have a lower car vandalism risk because there is no entry point.

Final thoughts on vehicle vandalism

Because vehicle vandalism can sap hundreds of dollars in repairs or be stressful and messy to claim through insurance, it’s best to avoid the risk as much as possible. We hope that you’ve learned more about how protection against the cost of vandalism starts with setting your deductible, choosing the right coverage and taking care where you leave your vehicle. Let our isure representatives help you craft your auto insurance policy with the best coverage. And, if you do experience an act of vehicle vandalism, we can help walk you through the steps to filing a claim.